UTRECHT, NETHERLANDS – In its latest update, Rabobank examined how the 2021 poultry market will continue to be volatile and what steps the industry will need to take to overcome the challenges.

The banking and financial service company explained how the margins of the global poultry industry remain down with the difference between companies bigger than previously seen.

“We can expect further changes in markets and supply conditions in the short and long term,” said Nan-Dirk Mulder, senior analyst for animal protein at Rabobank. “These big changes will require a constant fine-tuning by investors to optimize their position under changing short- and long-term market conditions. Companies that do this right will be able to outpace the industry and strengthen their individual market position.”

Rabobank examined the three stages that the poultry industry will take in order to maneuver the next steps of the COVID-19 pandemic recovery.

The report explained that the first step was the pandemic disruption felt in 2020 which caused significant fluctuation in markets, trade and supply chains. Rabobank said there were bigger differences in performance between companies then ever seen before.

Going into 2021, the report said a dual market road to recovery could have important impacts in the global and regional industry.

“Ups and downs of the pandemic in the first half of the year will lead to ongoing impacts on channels, with peaking retail and online demand and low foodservice demand, especially during lockdowns,” Mulder said. “Conditions will start to gradually recover when Covid-19 becomes a bit more controlled in the second half of 2021 and into 2022, as vaccinations become more widely used. This all happens in a context of high and volatile feed costs.”

The report stated that with a dual-market trend, consumers could also have high spending power driving up demand for premium products in retail with price-focused consumers who have been economically affected by the pandemic on the other side.

Mulder stressed market positioning, cost control, procurement and supply management during stage 2. Consolidation is also expected to gradually accelerate according to the report.

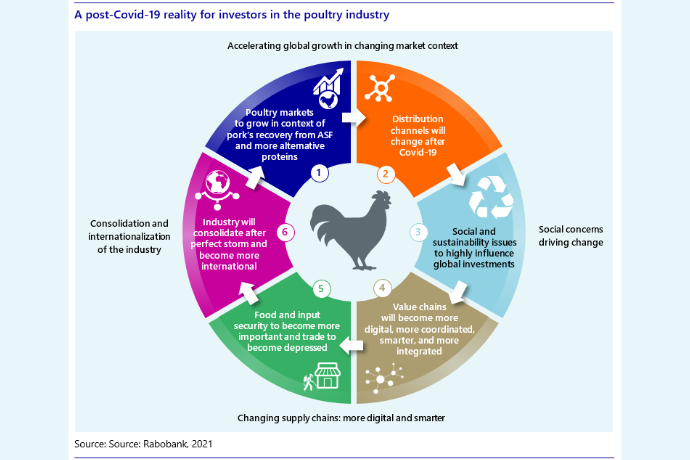

Finally, in stage three which will start in 2022, there will be a return in bullish investment in the global industry according to Rabobank. The group expects key investments will be different before COVID-19.

“Poultry demand will be characterized by strong, ongoing demand despite ASF recovery and alternative protein growth,” the report said. “Distribution channels will change, with continuing, robust at-home and online sales, which will also change product mix opportunities. Value chains will become more digital, smarter, and more sustainable, and food and input security will push toward more local supply and pressured trade.”