KANSAS CITY, MO. — Food and beverage manufacturers are embracing the future through the adoption of automation, digital manufacturing and Industry 4.0. However, this journey into the digital age is not the same for every company.

For some manufacturers, it provides a potential solution to labor challenges, for others digitalization offers efficiencies to help streamline operations.

While there is no cookie cutter formula for this digital transformation, a close examination of the current state of the industry can provide valuable insights to manufacturers preparing to take the next step in the journey.

CRB, a provider of sustainable engineering, architecture, construction and consulting to the food and beverages and life sciences industries, has taken a deep dive into the digital side of manufacturing in its newly released “Horizons: Digital Age of Food Manufacturing” report.

“You won’t find many answers in the general conversation about Industry 4.0,” said Jason Robertson, vice president of Food & Beverage at CRB, in the report’s introduction. “The term has become a catch-all for shiny new technologies, making it seem both inevitable and impractical — a difficult combination for any manufacturer trying to figure out exactly how to move their business forward, particularly at a time of high inflation and reduced capital spending.

“We offer this report as a searchlight amid that confusion, illuminating the path ahead by exploring Industry 4.0 not as a catch-all term but as a concrete objective enabled by realistic, incremental steps. This is no general conversation — this is a close and specific examination of the digital era, as experienced and reported directly by your peers,” Robertson said.

CRB’s latest Horizons report examines feedback from more than 300 respondents, all food and beverage leaders. The 65-question survey generated more than 19,000 data points, which are summarized in the company’s report. CRB has previously issued Horizons reports on the alternative protein industry in both 2021 and 2023.

Respondents were equally divided between large companies earning more than $100 million in annual revenue and smaller companies. Thirty-percent of respondents worked in operations, plant engineering or maintenance; 21% in corporate management; 14% in purchasing or procurement; 13% in logistics or supply chain; and 12% in product, process or package development. There were also corporate engineers, regulatory affairs, and quality assurance and control representatives participating in the survey.

Twenty-five percent of respondents worked at manufacturers that produced baking and snack products; 20% dairy products; 17% alternative meats; 17% meat, poultry or seafood; and 14% produced pet food. The beverage industry, ingredients, confectionary, prepared meals, dressings and sauces and alternative dairy markets were also represented in the survey.

Benchmarking the journey

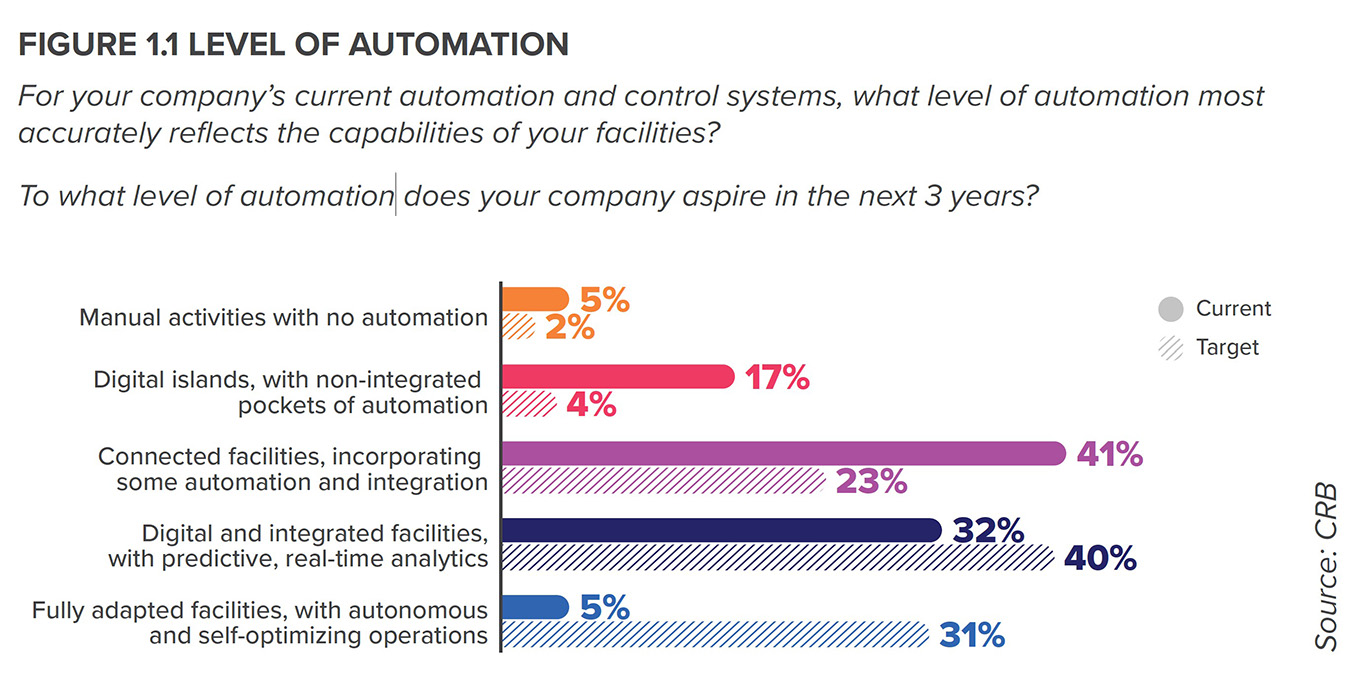

Before analyzing the digitalization journey in manufacturing, CRB first looked at where companies were today with regard to automation and control systems.

CRB grouped the companies in the survey into one of five tiers of digital plant maturity — outlining where they currently are in their digital manufacturing journey.

- 1st tier: Fully manual operation (5%)

- 2nd tier: Digital islands with non-integrated pockets of automation (17%)

- 3rd tier: Connected facilities incorporating some automation and integration (41%)

- 4th tier: Digital and integrated facilities with predictive real-time analytics (32%)

- 5th tier: Fully adapted facilities with autonomous and self-optimizing operations (5%)

Most respondents fell into the mid-range of automation, having some level already in their facilities, but with goals in the next three years to increase those levels.

Source: CRB

Source: CRBAll survey participants were also asked about their familiarity with specific terms and systems that pertain to automation, Industry 4.0 and digital manufacturing including artificial intelligence (AI), cybersecurity, Internet of Things (IoT), with which most respondents were familiar, and AGV (automated guided vehicle), AMR (automated mobile robot), digital twins (software-generated models of a physical asset that allow simulation, testing and training without the physical asset) and cobot (robots that safely perform a task in conjunction with a human or aid a human in their task), with which fewer respondents were familiar.

“When we asked respondents to identify which elements of an automated, integrated and digital factory would have the most positive impact on their company, AI, a connected supply chain, advanced analytics, IT/OT and IoT topped the list,” Thompson and Jim Vortherms, senior director of Control Systems Integration at CRB, wrote in the report. “We take this as a positive sign, especially when combined with the number who have already implemented those elements fundamental to achieving the goal of a digital factory — IT/OT (62%), cybersecurity (61%) and control systems integration (51%). You can’t have AI without IT/OT and control systems integration.”

When asked how automation and Industry 4.0 technologies will benefit their companies, 70% of respondents ranked productivity highest. This included increased output or yield, reduced labor or costs, reduced downtime, cleaning or changeover between existing products. Other benefits included quality, including reduced defects or recalls; agility, such as the ability to manufacture different products or the flexibility of the production line; and speed, the ability to bring new products to market faster. Fifty-five percent of respondents ranked quality as a top benefit, while 39% and 35% ranked agility and speed as top benefits, respectively.

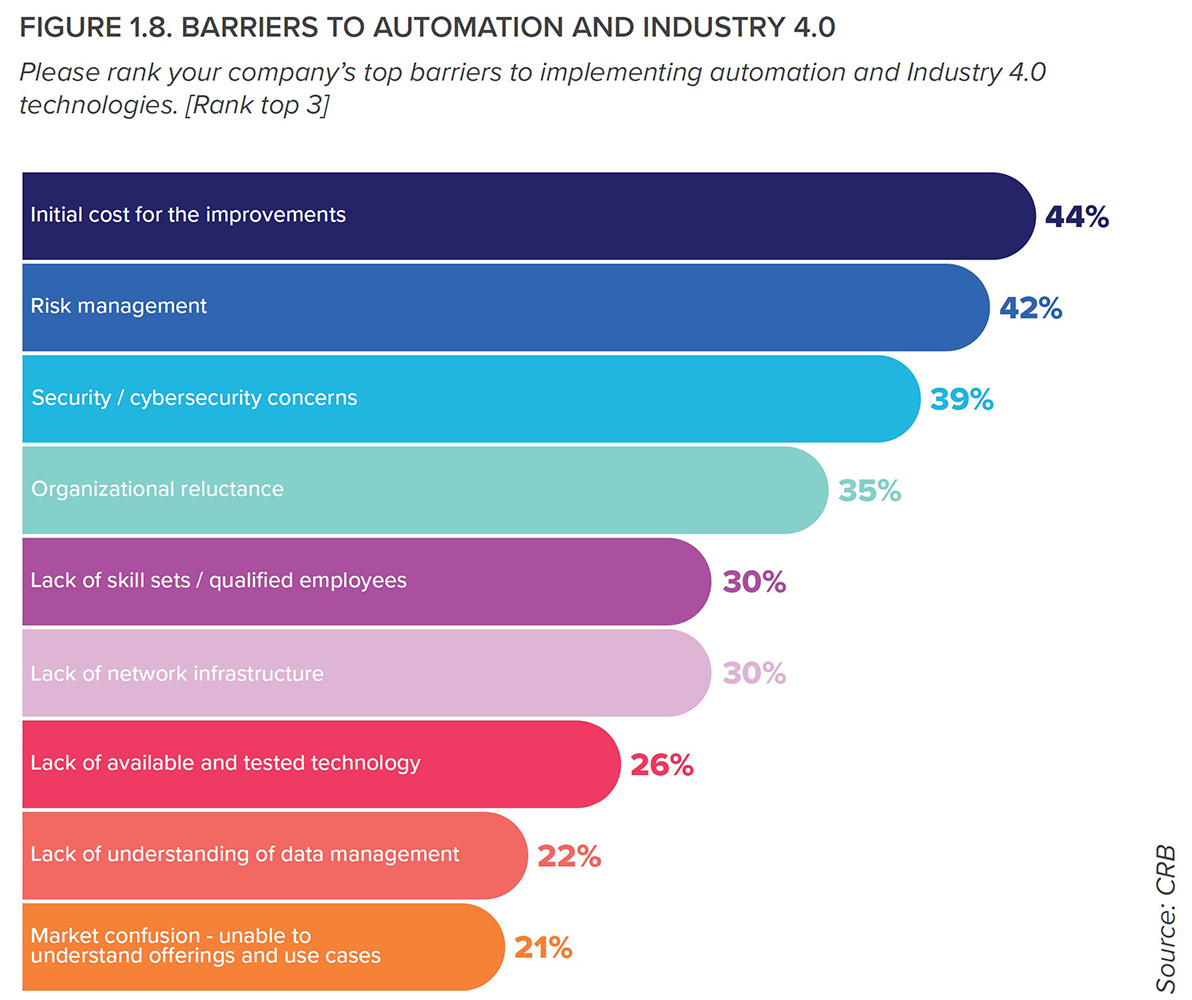

Incorporating automation and Industry 4.0 into a manufacturing operation obviously takes time and money, which was reflected in 44% of respondents choosing capital expense as a significant barrier to implementing these technologies. Other significant barriers included risk management (42%), cybersecurity concerns (39%) and organizational reluctance (35%).

“Cost is the biggest impediment to investing in digital transformation — that’s not a surprise,” Thompson explained. “The call for capital is very high right now.”

Capital cost was chosen as a barrier more often by respondents from smaller companies — 58% of those whose companies have annual operating revenue less than $20 million, compared to 32% of those from companies with revenue greater than $500 million. Organizational reluctance was less of a factor for larger companies (28%) than for smaller ones (41%).

“This makes sense given that companies with lower operating revenue have less capital available to spend on improvements, the benefits of which are not easy to quantify or have a longer ROI [return on investment],” Thompson and Vortherms wrote. “Of course, you can’t directly measure the value of becoming a data-driven, digital-first manufacturing organization the way you can calculate the benefit of an improvement in something like overall equipment effectiveness. Providing additional education on the technologies, their benefits and their application to manufacturers should alleviate some of the resistance to implementation. In the end, though, it still comes down to available capital.”

Source: CRB

Source: CRBLabor challenges

Automation and digital manufacturing technologies are often seen as the solution to labor shortages in manufacturing industries.

“Conventionally, digital transformations and automation have been viewed as solving labor shortages by replacing workers. But there’s a lot more to the story than that,” Vortherms and Katie Ireland, principal engineering of Packaging at CRB, wrote in the labor section of the report. “It can make companies much more attractive places to work for the generations that grew up in the digital world and are now entering the workforce.”

When asked how their companies are working to combat labor shortages, 78% of respondents reported that automating the manufacturing process was a solution they planned to implement and 77% planned to standardize processing and equipment — both of which show a push toward more digitalization.

Source: CRB

Source: CRB“Given that 31% of respondents come from companies with annual capital budgets of less than $20 million, it’s promising that more than 70% of respondents have either implemented, or plan to implement, major automation and Industry 4.0 assets,” Vortherms and Ireland wrote. “Some smaller companies may not yet know what they want to automate, but if they’re expecting double-digit growth in the next three years, they need to anticipate how that growth will affect their current equipment and human asset base. Adding automated equipment that is prepped for digital transformation and planning for the personnel skill sets to run these new lines may be part of their change to keep up with the demand.”

CRB’s 85-page Horizons report offers analysis to the survey results as well as insights on how this journey into the digital age could affect food and beverage manufacturing operations now, and in the years to come.

“The future of food and beverage manufacturing is bright,” Thompson and Vortherms wrote. “Companies are aware of the ongoing digital transformation and are looking for innovative, cutting-edge technologies. But the transformation risks falling short unless the industry can see the full range of benefits and find the right partners for implementation. There are challenges to arriving at the destination — there always will be — but a future of automation and fully digitalized facilities is within reach.”

Read CRB’s full report.